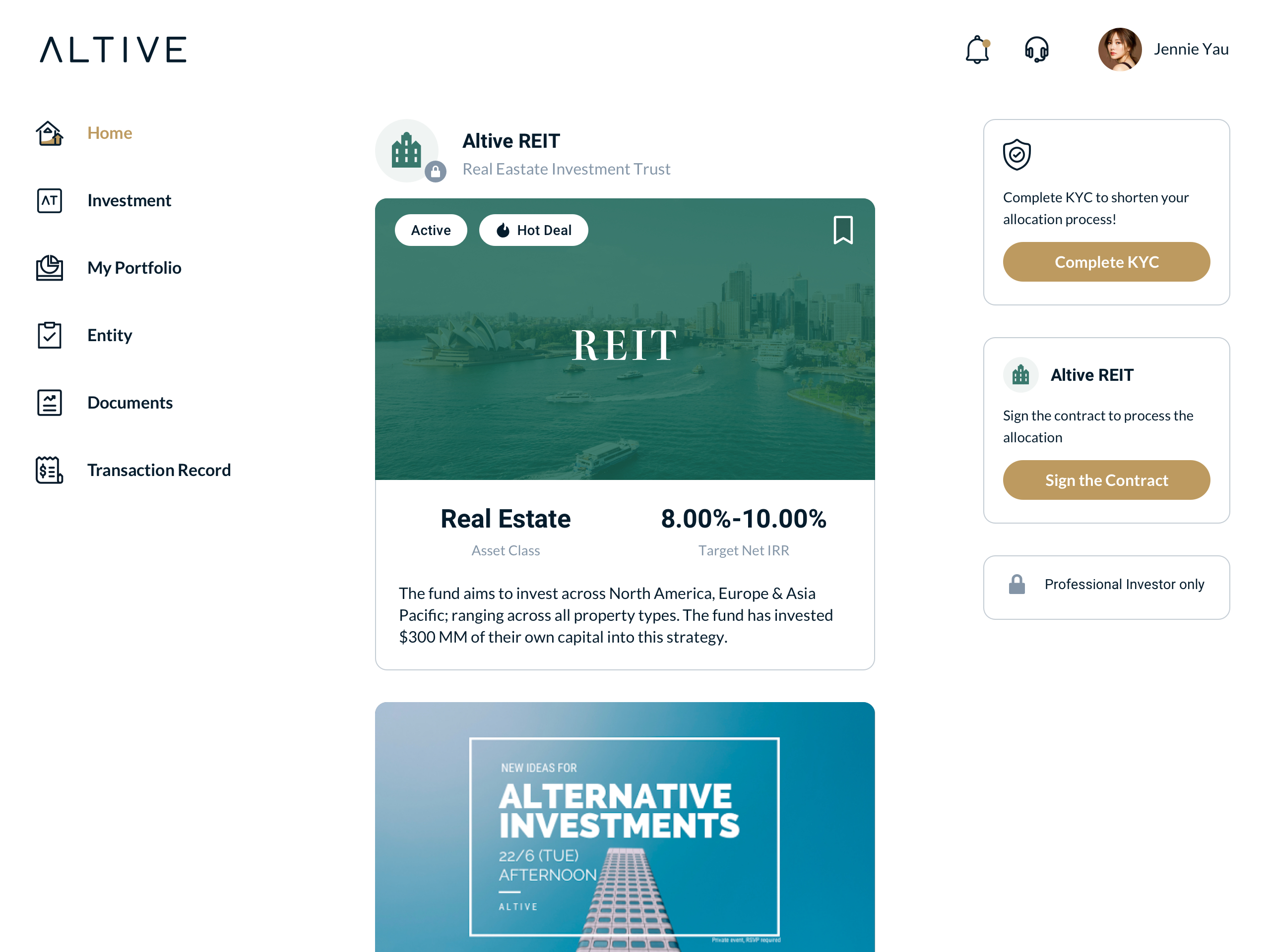

Altive Platform Features

We adopt a technology-first approach to private market investments with our digital platform built with these core principles in mind: fast, simple and secure. Users can access different product types, track records, terms and other important details upon completing KYC after registration.

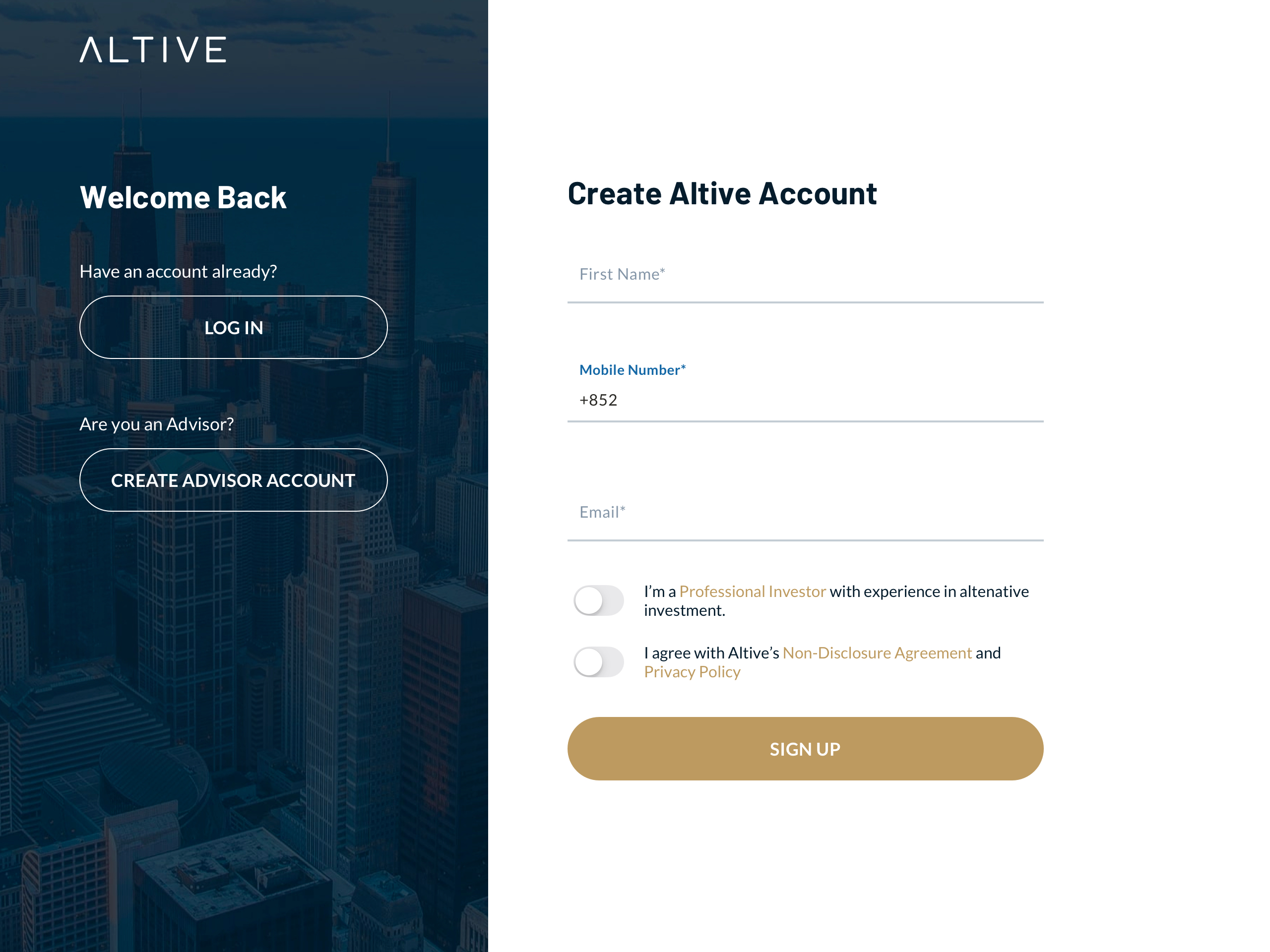

Get started quickly

Sign up now to browse through the various private market products handpicked by us.

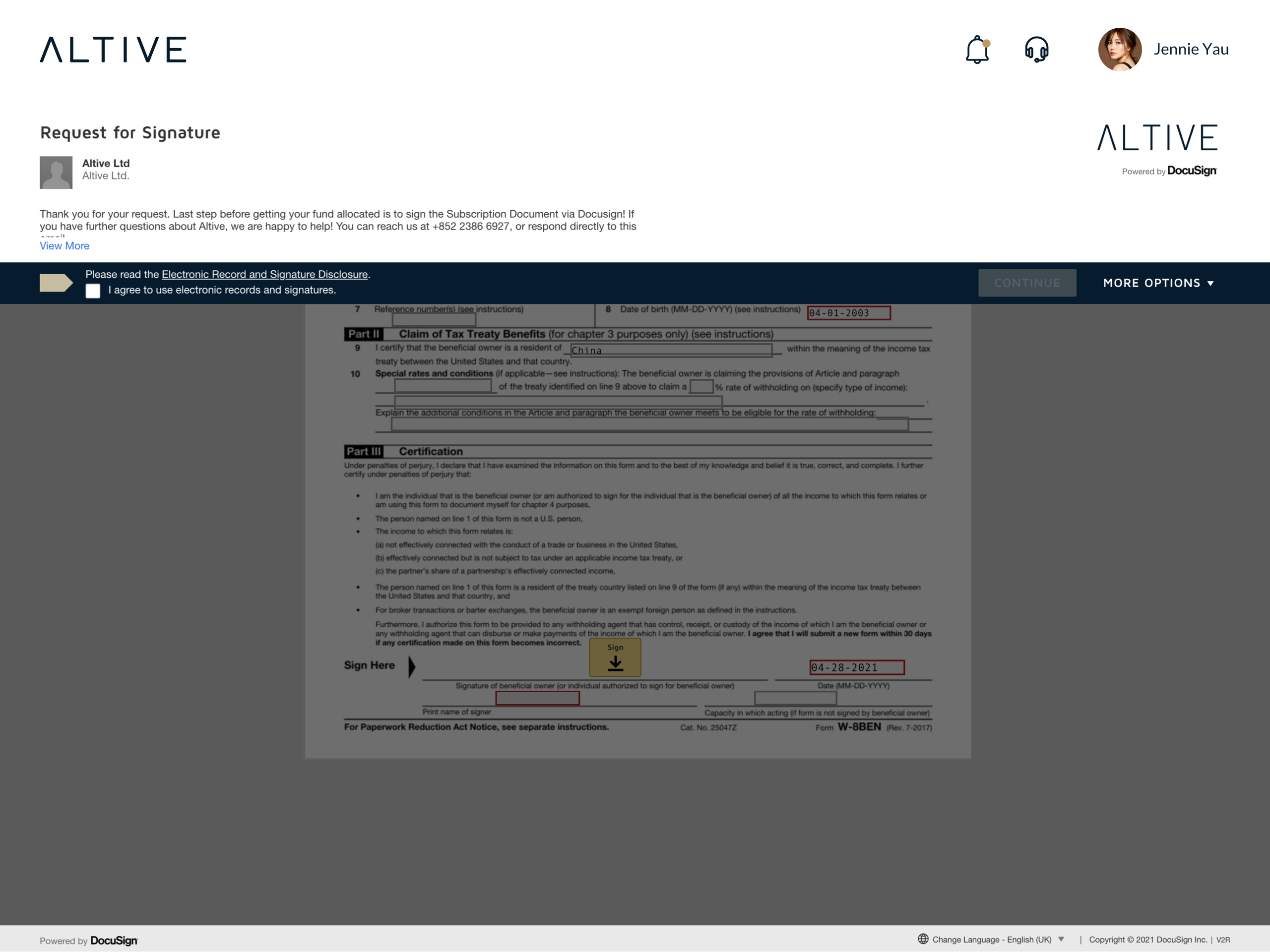

No paperwork burden

Complete the entire subscription process with just a few clicks on your mobile or computer. Fast, simple and secure.

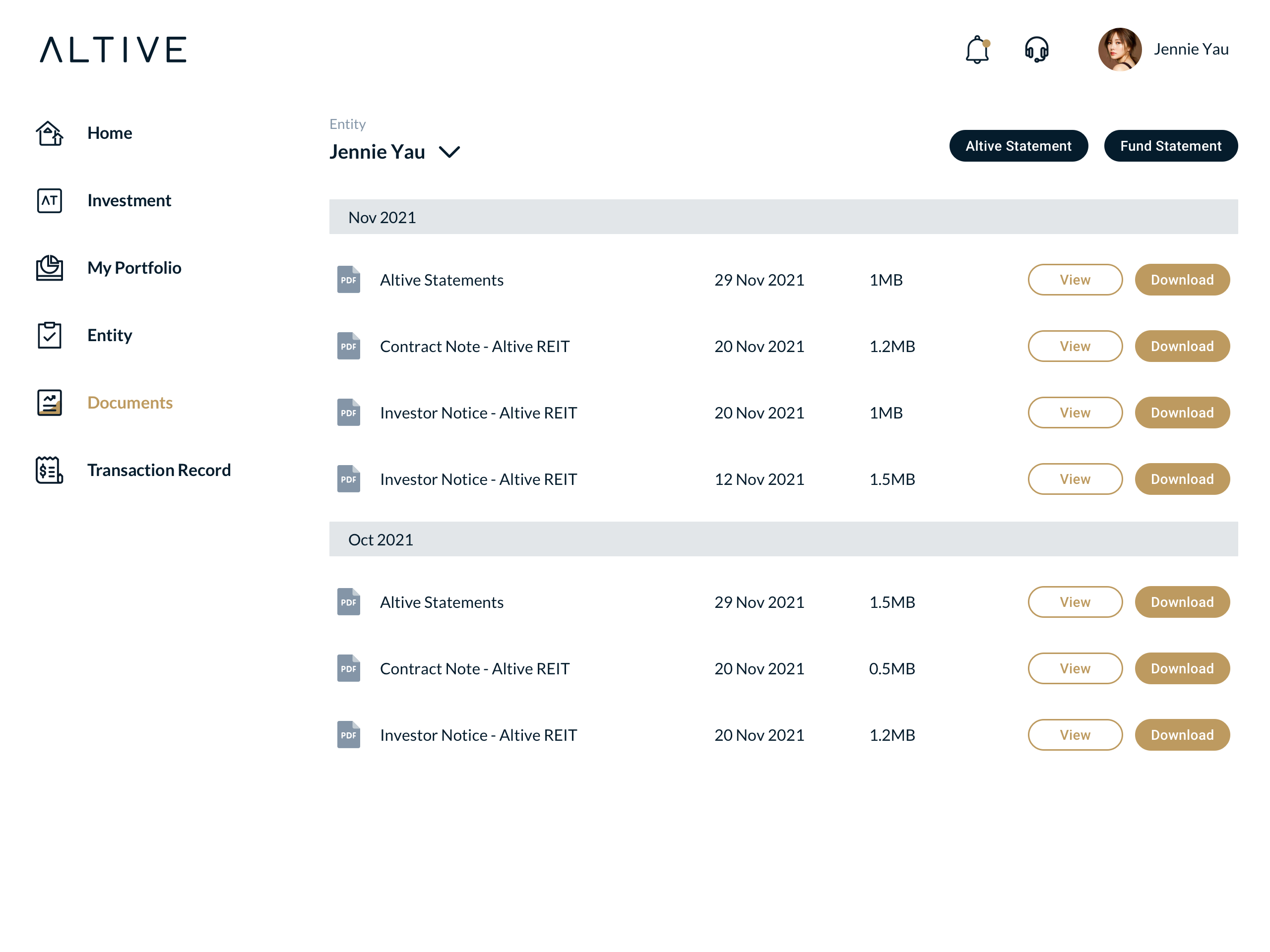

Single platform for all your needs

Performance reports, statements and investment records - all on a single platform.

FAQ about Altive

We are currently only open to Professional Investors (PI). You may refer to the definition of PI here.

Yes - you can register as an investor from other countries, subject to our KYC (Know Your Customer) and AML (Anti-Money Laundering) process. Contact us to learn more about your eligibility.

You can usually start investing in high-quality institutional financial products with Altive from as low as US$10,000. The minimum investment size might vary depending on each offering.

You can create an Altive account with your email and phone number on our platform here which only takes a few minutes. Our specialist will contact you shortly to get started. Once you are verified as a Professional Investor, you can start investing via your Altive account.

There are no fees associated with opening an Altive account. Nonetheless, they may be fees associated with subscribing to our products.

To start investing with Altive, you will be required to submit some essential documents required by law. These include (but are not limited to) your identity documents, proof of residential address and Professional Investor related asset proof. You can easily upload all the required documents on our digital platform.