Altive Platform Features

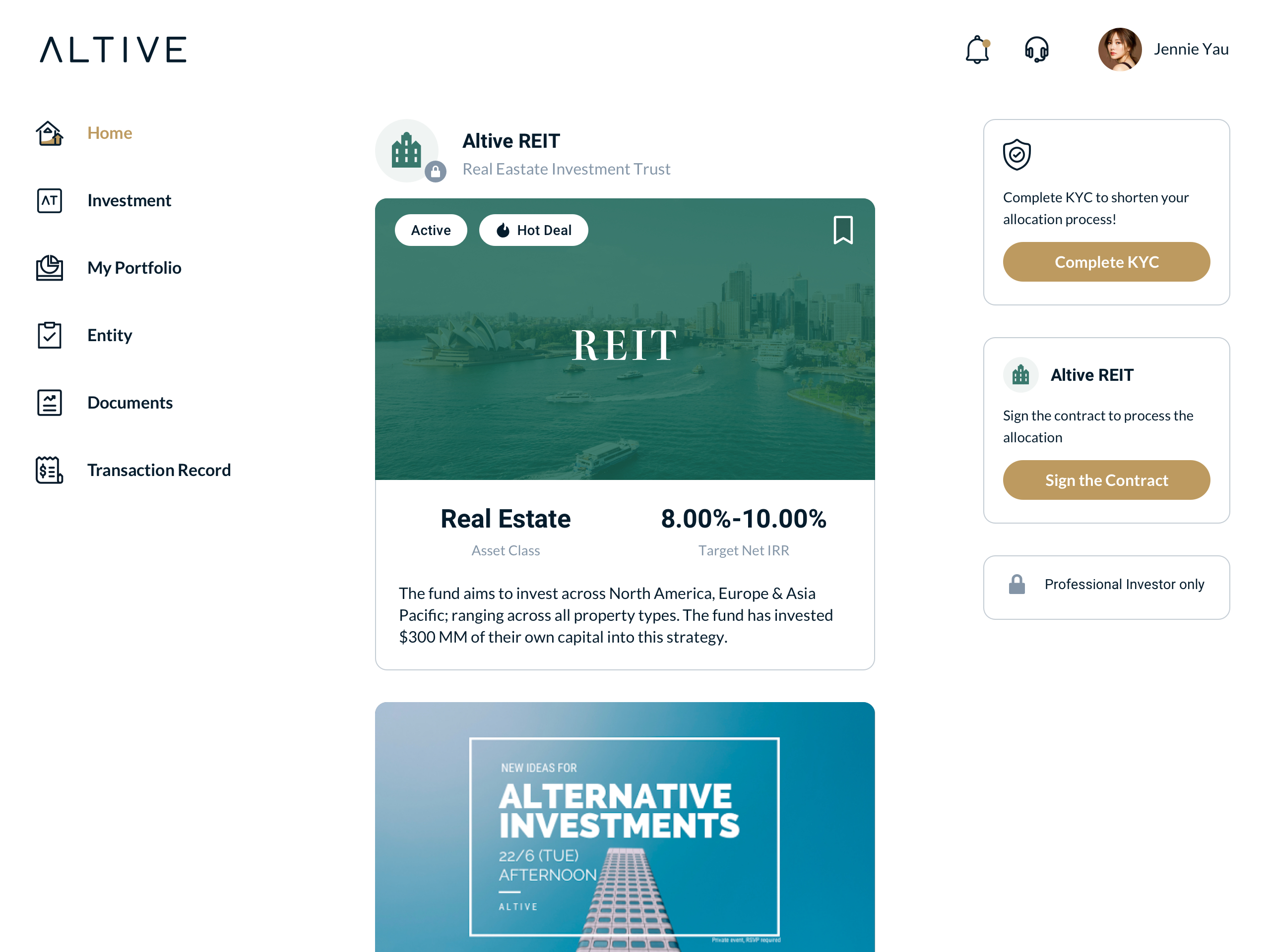

We adopt a technology-first approach to private market investments with our digital platform built with these core principles in mind: fast, simple and secure. Users can access different product types, track records, terms and other important details upon completing KYC after registration.

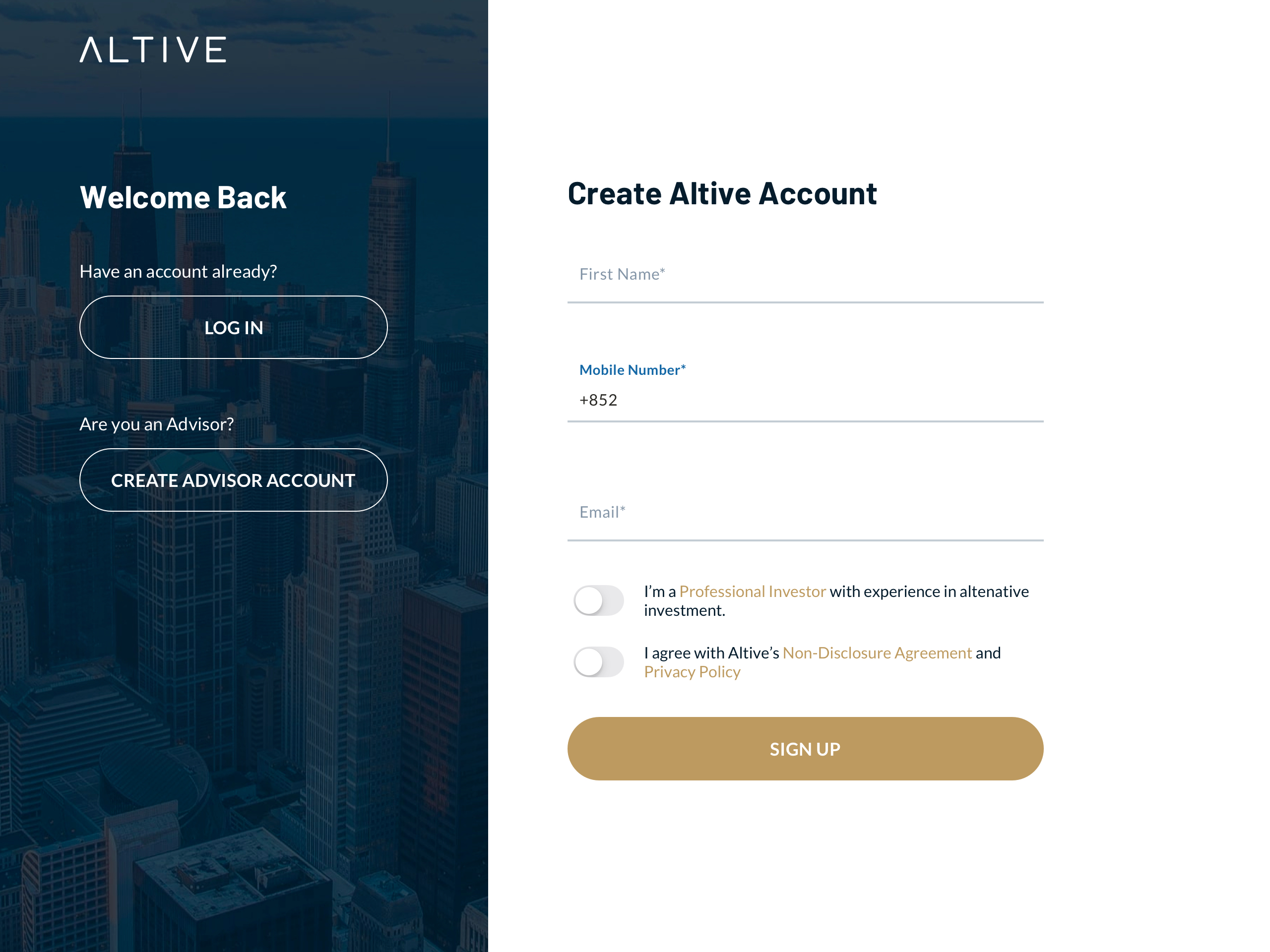

Get started quickly

Sign up now to browse through the various private market products handpicked by us.

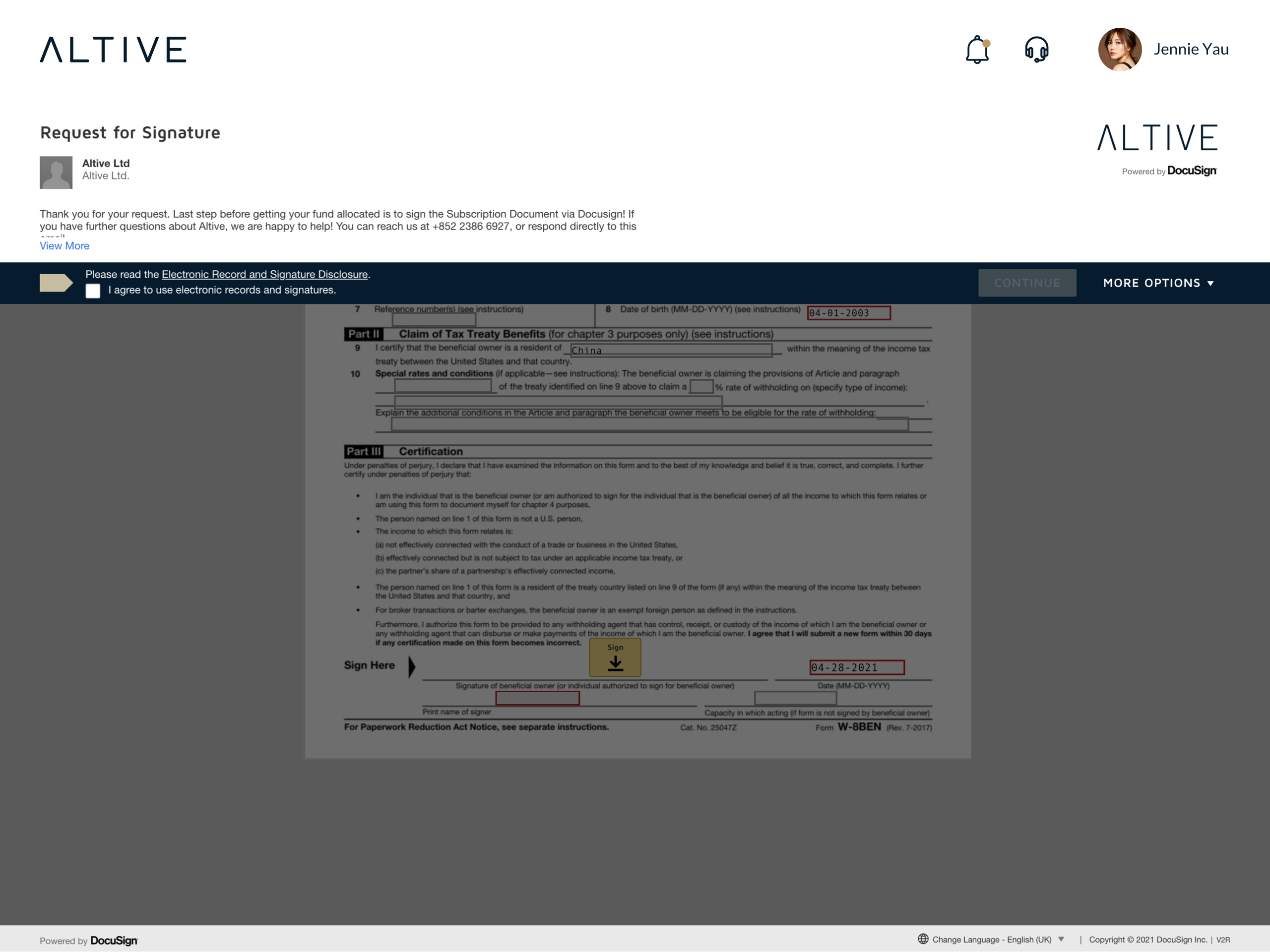

No paperwork burden

Complete the entire subscription process with just a few clicks on your mobile or computer. Fast, simple and secure.

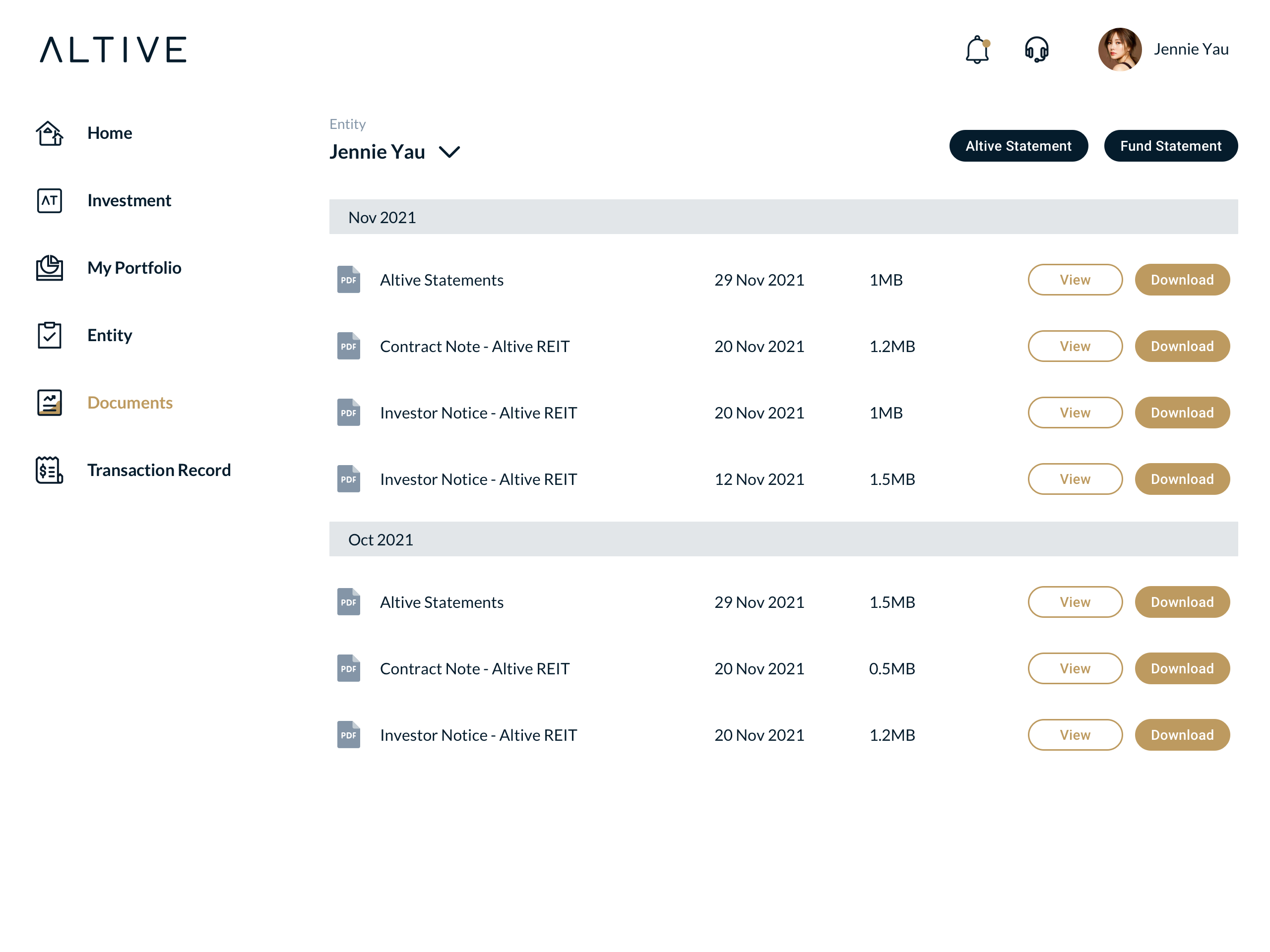

Single platform for all your needs

Performance reports, statements and investment records - all on a single platform.

FAQ about Altive

Altive is a technology-driven investment platform that allows wholesale investors to gain seamless access to institutional quality, alternative investment opportunities.

Altive exists to provide Australian wholesale investors with access to high-quality investment opportunities that previously were historically only available to large institutions such as Superannuation funds. Altive’s end-to-end technology platform allows wholesale investors to transact in institutional investment opportunities with a simple, safe and paperless process to access.

The opportunities are available to Australian wholesale investors. A wholesale investor is defined as an individual or entity with either net assets over AUD$2,500,000 or income of at least $250,000 (each of the previous two financial years).

Our aim is to make the onboarding process seamless for investors. Registration to Altive is easy, simply requiring electronic verification of identity plus KYC & AML checks. These are completed via the Altive platform with the assistance of our client service team.

Currently the minimum investment into opportunities on the Altive platform range from AUD$5,000 to AUD$100,000. We expect this minimum investment amount to reduce as the platform continues to grow.

Altive partners with some of the most successful investment managers from around the world. Each of these managers has highly experienced teams and the tools needed to bring together the best investment insights. The Altive platform also provides access to a selection of institutional-quality late-stage private companies. The investment selection criteria are to identify companies that are - Innovative industry leaders with >$1b market capitalization - Leveraged to structural trends across disruptive technologies - Backed by strong institutional investors - Targeting an IPO within 2-4 years

Altive has a 10-person sourcing and investment team who undertake due diligence on potential investment opportunities. Altive also has an independent investment committee made up of institutional investment professionals who have deep industry experience. The team completes investment and operational due diligence on each opportunity to assess the potential merits and risks an investor faces.

Altive was founded and is based in Hong Kong. The investment, and operations support teams are predominantly based in the Hong Kong office. Altive also has presence in Singapore, China, Japan and Sydney. Altive is licensed by the Australian Securities and Investment Commission or ASIC, which is the financial services regulator for Australia (AFS License Number 532545). Altive is also licensed under Hong Kong Securities and Futures Commission.